Rystad Energy Reports

Rystad Energys report also confirms that global production of petroleum liquids and biofuels are on track to pass 100 million bpd this year representing an increase of about 2 million bpd from 2018. Rystad Energy expects FPSO awards to reach a total of 10 units in 2021 with another 10 following next year creating a very healthy project line-up for contractors effectively doubling their pipeline.

Rystad Energy New Opportunities Emerge As Pandemic Worries Continue

Rystad expects shale and tight oil investments will take the biggest hit now forecast to fall by 522 yy to US673 billion.

Rystad energy reports

. While some of these planned divestments were announced before the Covid-19-related oil price crash more were added in reaction to the pandemic and its aftermath. OSLO Norway COVID-19 s impact on the oil price will limit free cash flow from fields produced via FPSOs according to consultant Rystad Energy. Pumped storage will cover the long duration dips in wind and solar while short-duration shifts will be covered by lithium-ion batteries. Its analysis reveals that while oil and gas-focused businesses on average saw revenue drop 23 in 2020 from the previous year wind and solar PV-focused businesses enjoyed an 18 growth in sales.Access your free report here. Oil and gas companies currently have assets for sale with recoverable reserves of more than 5 billion bbl of liquids and 75 billion boe of natural gas Rystad Energy estimates. With auctions already adopted throughout Latin America Rystad Energy expects the regions 49 GW of renewable capacity will skyrocket to 123 GW by 2025 with the biggest increases coming from Brazil Mexico Chile Colombia and Argentina. Also notable in the report is the observation that global production of natural gas liquids NGL has passed 10 million bpd while an additional 5 million barrels comes from refinery gains and.

Rystad Energy expects the most mature form of energy storage namely pumped storage to increase from 14 GW in 2020 to 10 GW in 2040. Our latest Renewable Energy Trends report includes a deep dive into MA activity year-to-date. By monitoring recent developments. Assets at an early stage of development dominate MA.

When it comes to breakeven prices and potential liquids supply in 2025 for the main sources of new production Rystad Energy data shows that from. Looking at five-year intervals total offshore project commitments declined in the period 2016-2020 to 355 projects down from 478 in the period 2011-2015. The last reported AGM Annual General Meeting of Rystad Energy India Private Limited per our records was held on 30 June 2020. Rystad Energys initial assessment of Hurricane Idas impact on US oil production and refinery capacity estimates a peak daily supply curtailment of 18 million bpd in the Gulf of Mexico which currently has a peak daily production capacity of 19 million bpd.

Rystad Energys Gas Market Yearly Report 2020 is now available. Rystad Energy India Private Limited has two directors - Parul Chopra and Vijandran Rathakrishnan. As a result of the deadlock Rystad Energy estimates that the delays in reaching a financial investment decision FID and conducting engineering procurement and construction EPC works will postpone Papua LNGs first production to 2026 and the PNG LNG expansion to 2029. Before the Covid-19 pandemic Rystad Energy expected total upstream investment would maintain last years levels both in 2020 and 2021.

December 17 at 225 AM. Rystad will update its report with new 2019 projections at. Access is usually limited to clients only but this year we are publishing an exclusive condensed version available for download through our Free Analytics. Rystad Energy has compared the revenues of 170 listed suppliers exposed to the upstream oil and gas wind and solar markets.

Also as per our records its last balance sheet was prepared for the period ending on 31 December 2019. Worlds recoverable oil down 9 The amount of remaining recoverable oil resources in the world is 9 lower than last year according to a new Rystad Energy. Rystad Energys new global emissions report refers to numbers from 2018 given the wide discrepancy of country-level data quality for 2019. For the purpose of this analysis Rystad has defined that a project is committed when more than 25 of its overall greenfield capex is awarded through contracts.

Some that have recovered more than 75 of their fields original resources have been producing. Rystad Energys comprehensive Covid-19 monthly report calculates the effect of the pandemic on our lives and offers updated estimates for global energy markets. Oilsands investments will follow with a decline of 44 to US51 billion. Four FPSOs were awarded in the second quarter and Rystad believes another four will be awarded before the end of the year.

A Rystad Energy report has shown that natural gas flaring at US non-upstream onshore oil and gas facilities reached an 18-month high in February 2021 at 1809 million ft 3 d.

Rystad Energy Gas Market Analytics

Rystad Energy Oil Market Analytics

Rystad Energy Us Shale Growth Could Once Again Pave The Way To An Oversupplied Market

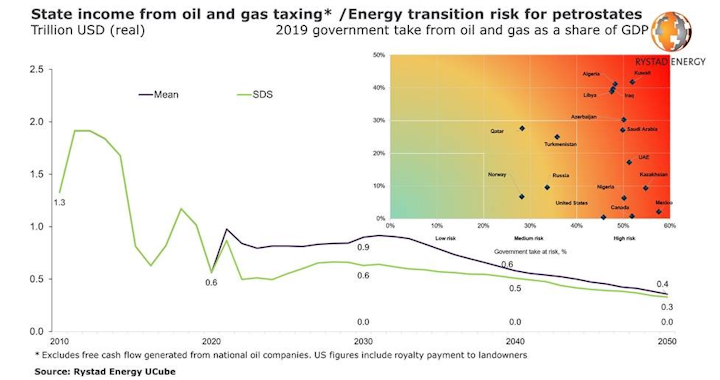

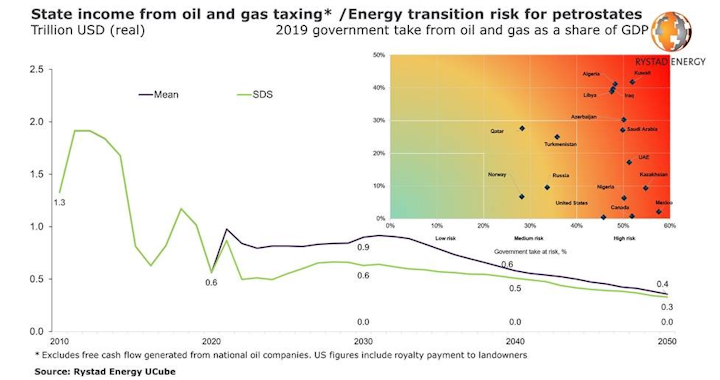

Rystad Accelerating Energy Transition Marks End Of Trillion Dollar Oil And Gas Tax Revenues Oil Gas Journal

Rystad Energy 2nd Energy Transition Report Ccs Could Tap 62 Of World S Co2 Emissions Global Geological Storage At 11 500 Gt Only 49 Of Global Emissions Are Priced

Rystad Energy Three Light Tight Oil Production Trends That Will Sway 2019 Growth

Rystad Energy Fabricators Are Building Backlog

Energy Transition Report Asia To Remain Mother Of Batteries Cell Supply Deficit Coming After 2025 Net Zero Is The New Black Energy Northern Perspective

Rystad will update its report with new 2019 projections at. OSLO Norway COVID-19 s impact on the oil price will limit free cash flow from fields produced via FPSOs according to consultant Rystad Energy.

Rystad Energy 2nd Energy Transition Report Ccs Could Tap 62 Of World S Co2 Emissions Global Geological Storage At 11 500 Gt Only 49 Of Global Emissions Are Priced

Worlds recoverable oil down 9 The amount of remaining recoverable oil resources in the world is 9 lower than last year according to a new Rystad Energy.

Rystad energy reports

. Rystad Energys Gas Market Yearly Report 2020 is now available. Some that have recovered more than 75 of their fields original resources have been producing. A Rystad Energy report has shown that natural gas flaring at US non-upstream onshore oil and gas facilities reached an 18-month high in February 2021 at 1809 million ft 3 d. For the purpose of this analysis Rystad has defined that a project is committed when more than 25 of its overall greenfield capex is awarded through contracts.Rystad Energy India Private Limited has two directors - Parul Chopra and Vijandran Rathakrishnan. Access is usually limited to clients only but this year we are publishing an exclusive condensed version available for download through our Free Analytics. Oil and gas companies currently have assets for sale with recoverable reserves of more than 5 billion bbl of liquids and 75 billion boe of natural gas Rystad Energy estimates. Rystad Energy expects the most mature form of energy storage namely pumped storage to increase from 14 GW in 2020 to 10 GW in 2040.

By monitoring recent developments. Four FPSOs were awarded in the second quarter and Rystad believes another four will be awarded before the end of the year. Also notable in the report is the observation that global production of natural gas liquids NGL has passed 10 million bpd while an additional 5 million barrels comes from refinery gains and. The last reported AGM Annual General Meeting of Rystad Energy India Private Limited per our records was held on 30 June 2020.

Before the Covid-19 pandemic Rystad Energy expected total upstream investment would maintain last years levels both in 2020 and 2021. Rystad Energys initial assessment of Hurricane Idas impact on US oil production and refinery capacity estimates a peak daily supply curtailment of 18 million bpd in the Gulf of Mexico which currently has a peak daily production capacity of 19 million bpd. Assets at an early stage of development dominate MA. Oilsands investments will follow with a decline of 44 to US51 billion.

Rystad Energy has compared the revenues of 170 listed suppliers exposed to the upstream oil and gas wind and solar markets. With auctions already adopted throughout Latin America Rystad Energy expects the regions 49 GW of renewable capacity will skyrocket to 123 GW by 2025 with the biggest increases coming from Brazil Mexico Chile Colombia and Argentina. Also as per our records its last balance sheet was prepared for the period ending on 31 December 2019. Looking at five-year intervals total offshore project commitments declined in the period 2016-2020 to 355 projects down from 478 in the period 2011-2015.

Access your free report here. Its analysis reveals that while oil and gas-focused businesses on average saw revenue drop 23 in 2020 from the previous year wind and solar PV-focused businesses enjoyed an 18 growth in sales. Rystad Energys new global emissions report refers to numbers from 2018 given the wide discrepancy of country-level data quality for 2019. Pumped storage will cover the long duration dips in wind and solar while short-duration shifts will be covered by lithium-ion batteries.

December 17 at 225 AM. Our latest Renewable Energy Trends report includes a deep dive into MA activity year-to-date. As a result of the deadlock Rystad Energy estimates that the delays in reaching a financial investment decision FID and conducting engineering procurement and construction EPC works will postpone Papua LNGs first production to 2026 and the PNG LNG expansion to 2029. While some of these planned divestments were announced before the Covid-19-related oil price crash more were added in reaction to the pandemic and its aftermath.

Rystad Energys comprehensive Covid-19 monthly report calculates the effect of the pandemic on our lives and offers updated estimates for global energy markets. When it comes to breakeven prices and potential liquids supply in 2025 for the main sources of new production Rystad Energy data shows that from.

Rystad Energy Three Light Tight Oil Production Trends That Will Sway 2019 Growth

Rystad Accelerating Energy Transition Marks End Of Trillion Dollar Oil And Gas Tax Revenues Oil Gas Journal

Rystad Energy Oil Market Analytics

Energy Transition Report Asia To Remain Mother Of Batteries Cell Supply Deficit Coming After 2025 Net Zero Is The New Black Energy Northern Perspective

Rystad Energy Gas Market Analytics

Rystad Energy Fabricators Are Building Backlog

Rystad Energy Us Shale Growth Could Once Again Pave The Way To An Oversupplied Market

Rystad Energy New Opportunities Emerge As Pandemic Worries Continue

Posting Komentar untuk "Rystad Energy Reports"